The Intersection of Geopolitics and Energy

By Peter Tchir and Michael Rodriguez

As many of you know, Academy Securities has an Advisory Board which includes both Wall Street Veterans and Military Veterans that has helped guide the firm in its growth. One part of that growth has been the Geopolitical Intelligence Group which is comprised of 10 former Generals and Admirals. These Generals and Admirals bring a wealth of knowledge and contacts to the table that we share with our clients. Rachel Washburn, who served as an intelligence officer in the army, is exceptionally well suited to getting the most out of this group and is the point person for anything Geopolitical. We provide anything from in depth bespoke projects, to more conversational podcasts, to reports, which we call SITREPS, in keeping with adherence to our mission as a Veteran Owned Firm. Recent SITREPS have been focused on the Kingdom of Saudi Arabia and have provided insights that are proving to be correct.

As we continue to enhance what we deliver to clients, we have been working to link in our Macro Strategy with our Geopolitical Expertise whenever possible. Much of our macro strategy is fixed income and credit market focused and it doesn’t always have a geopolitical aspect, but there are two key areas where Macro and Geopolitics are entwined – Emerging Markets and Energy.

These two areas stick out as it’s nearly impossible to analyze energy production and not discuss geopolitics, while emerging markets and geopolitical risk go hand in hand.

Geopolitical Risk

Michael Rodriguez, a Marine Corps combat veteran, who completed an internship at Academy and has now joined full-time, worked with our Geopolitical Intelligence Group to create a ‘heat map’ of where the Geopolitical Risks, particularly the risk of armed combat, is highest.

It is a scary world when so much of the map is dark red (high risk) and light red (medium risk).

It is a scary world when so much of the map is dark red (high risk) and light red (medium risk).

This map helps explain why Geopolitical risk has become a topic of conversation amongst market participants. While today it is the Kingdom of Saudi Arabia attracting the attention, it was just a few weeks ago that it was Syria and Iran and Turkey and Russia. Before that it, was North Korea that was attracting the headlines. While markets may fixate on one region at a time, the reality is that these situations are developing continuously, and Academy Securities has the expertise to not only keep you apprised of the developments but to help you formulate views on the likely outcomes and what that means for your business or portfolio.

One thing that I found most interesting as the Geopolitical Intelligence Group developed this map was the assertion that you really couldn’t have a low risk country next to a high risk country, with Europe and Ukraine being the exception. Effectively, the risk of spillover from high risk countries or regions to their neighbors is high. In some cases, because there would be direct conflict, but as a general matter, instability and risk tend to ignore national borders in much of the world.

Global Oil Production

This chart looks at the world based on oil production data from the EIA. The dark blue countries are heavy producers with light blue representing small to medium size producers.

There should be no obvious surprises on this map. We could tweak it for different types of commodities, but I think it does a good enough job for our purposes, which is really to get to the next chart.

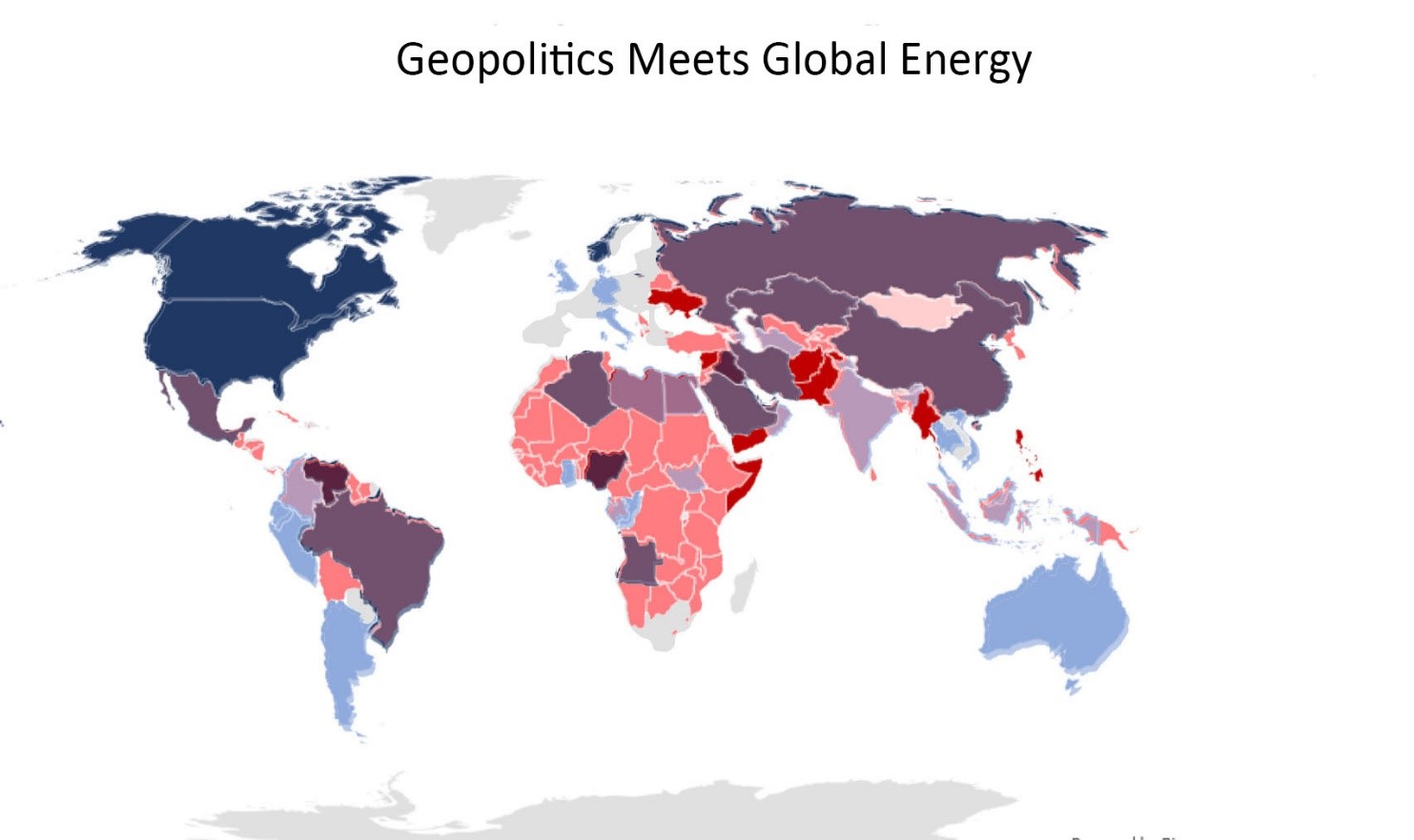

Geopolitics Meets Energy

This next chart attempts to meld the two charts into one. The concept is to identify regions for Academy Securities to focus on in terms of how the Geopolitical Risk can affect markets, but particularly, energy markets.

The dark blue is ‘safe’ energy production.

From a U.S. perspective, not only does energy production/energy independence create good jobs that support the economy, it plays into national defense as we aren’t reliant on foreign sources. Not being subject to the whims of other nations, particularly those with high levels of geopolitical risk is extremely beneficial. Our Geopolitical Intelligence group has also been able to help guide companies and investors through some of possible legislation that could impact the industry.

What is sometimes overlooked, is how important it is for other countries to secure sources of oil and liquid natural gas from stable suppliers. The combination of being ‘safe’ and a big producer is extremely powerful. It will play a role in our trade negotiations with China.

The map also highlights why we should continue to see higher volatility in Brent prices relative to WTI, with that spread often influenced by geopolitical issues.

To be brutally honest, the light red and red areas aren’t that important for our discussions on energy. They are areas of high geopolitical risk and are important in some cases to the global economy and particularly important to investors, especially if they are bond issuers, but they don’t play a major role in determining the price of oil.

Then we get to the heart of the matter – the purple zones. Purple represents the dangerous combination of high Geopolitical Risk with high energy production. These are the ‘hotspots’ that we will focus our geopolitical knowledge and resources on, in our efforts to help the macro analysis on energy prices. Much of the map is obvious, but I think the visual effect of the map is powerful in really drawing your attention to the hotspots.

Mexico jumps out at me.

The Middle East seems to be constantly in the news and while the latest developments in the Kingdom of Saudi Arabia have upped the ante, we’ve already discussed that in the SITREPS mentioned earlier (and we will continue to adapt our view as necessary as information comes out – though hopefully we will turn out to be right – we have been tracking the potential impact on Aerospace and Defense stocks and bonds – which you should have received earlier in the week).

Russia is another obvious area and one that we focus on regularly in our SITREPS and Podcasts.

But on this first cut, it is Mexico that stands out. We have just announced a trade agreement with Canada and Mexico and the currency is much stronger than it was in June, ahead of Mexico’s election, yet it shows up as still being relatively high on the Geopolitical Risk front and is a major energy producer.

Next Steps

The most obvious next step is doing a report on Mexico. We also are in the process of consolidating our geopolitical views on the purple regions to help formulate our views on energy prices.

We certainly think that the ‘safe’ production of the U.S. will play an important role in our trade negotiations with China (liquid natural gas is an obvious choice to reduce the trade deficit as China needs it and we produce it – cheaply and with low risk of unexpected supply disruptions).

On the sales and trading side of things, John Chang, another recently hired Marine Corps veteran, who is one of our agency discount note and corporate bond traders, is starting to send out runs on investment grade (and some high yield) energy bonds so that we can more directly translate our geopolitical and macro views into tradeable ideas.

Thank you for all your efforts and support and we look forward to continuing to grow and develop the products and services that can help you in your business or portfolio.

Original Post 10/22/2018