Month: October 2018

The Intersection of Geopolitics and Energy

The Intersection of Geopolitics and Energy

By Peter Tchir and Michael Rodriguez

As many of you know, Academy Securities has an Advisory Board which includes both Wall Street Veterans and Military Veterans that has helped guide the firm in its growth. One part of that growth has been the Geopolitical Intelligence Group which is comprised of 10 former Generals and Admirals. These Generals and Admirals bring a wealth of knowledge and contacts to the table that we share with our clients. Rachel Washburn, who served as an intelligence officer in the army, is exceptionally well suited to getting the most out of this group and is the point person for anything Geopolitical. We provide anything from in depth bespoke projects, to more conversational podcasts, to reports, which we call SITREPS, in keeping with adherence to our mission as a Veteran Owned Firm. Recent SITREPS have been focused on the Kingdom of Saudi Arabia and have provided insights that are proving to be correct.

As we continue to enhance what we deliver to clients, we have been working to link in our Macro Strategy with our Geopolitical Expertise whenever possible. Much of our macro strategy is fixed income and credit market focused and it doesn’t always have a geopolitical aspect, but there are two key areas where Macro and Geopolitics are entwined – Emerging Markets and Energy.

These two areas stick out as it’s nearly impossible to analyze energy production and not discuss geopolitics, while emerging markets and geopolitical risk go hand in hand.

Geopolitical Risk

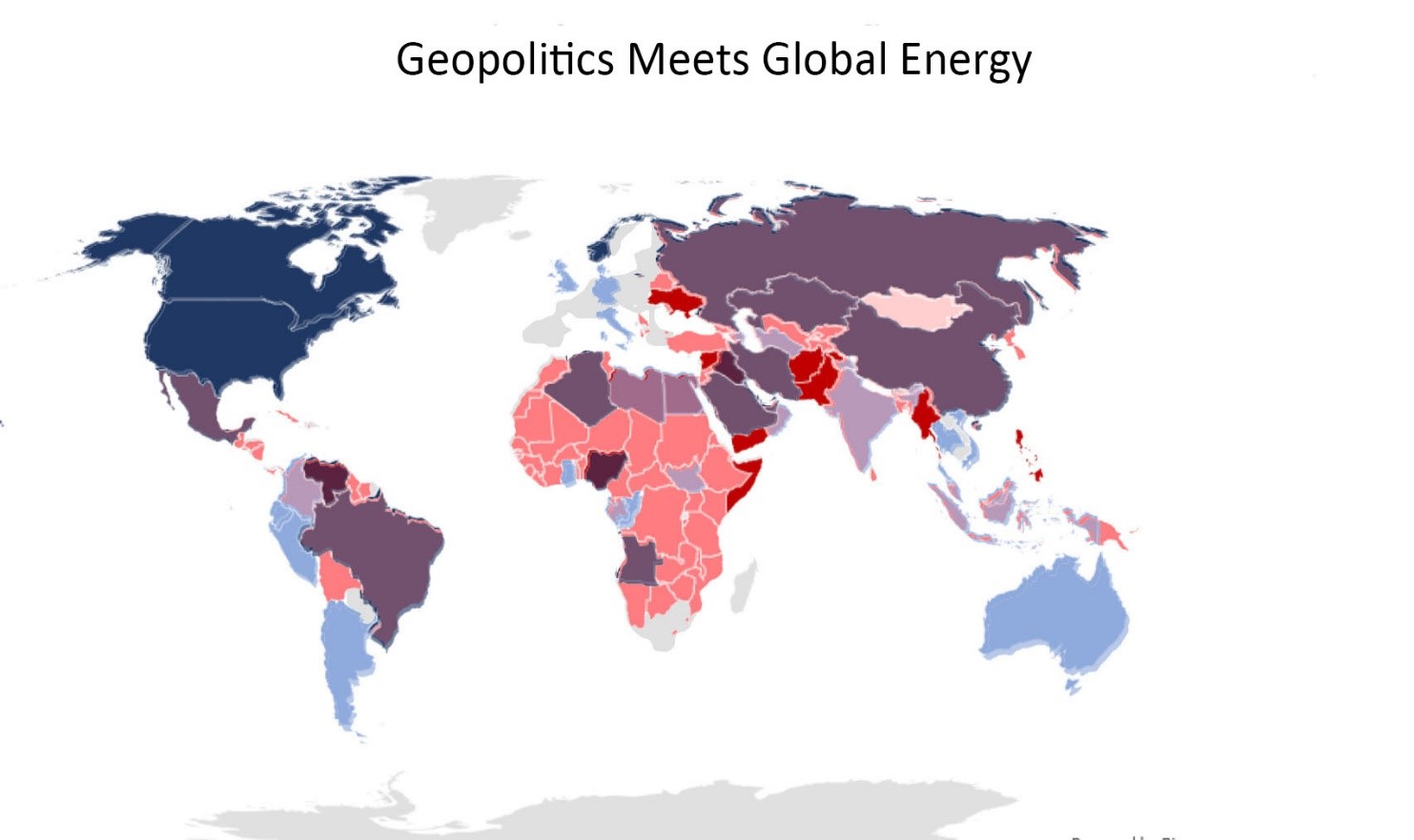

Michael Rodriguez, a Marine Corps combat veteran, who completed an internship at Academy and has now joined full-time, worked with our Geopolitical Intelligence Group to create a ‘heat map’ of where the Geopolitical Risks, particularly the risk of armed combat, is highest.

It is a scary world when so much of the map is dark red (high risk) and light red (medium risk).

It is a scary world when so much of the map is dark red (high risk) and light red (medium risk).

This map helps explain why Geopolitical risk has become a topic of conversation amongst market participants. While today it is the Kingdom of Saudi Arabia attracting the attention, it was just a few weeks ago that it was Syria and Iran and Turkey and Russia. Before that it, was North Korea that was attracting the headlines. While markets may fixate on one region at a time, the reality is that these situations are developing continuously, and Academy Securities has the expertise to not only keep you apprised of the developments but to help you formulate views on the likely outcomes and what that means for your business or portfolio.

One thing that I found most interesting as the Geopolitical Intelligence Group developed this map was the assertion that you really couldn’t have a low risk country next to a high risk country, with Europe and Ukraine being the exception. Effectively, the risk of spillover from high risk countries or regions to their neighbors is high. In some cases, because there would be direct conflict, but as a general matter, instability and risk tend to ignore national borders in much of the world.

Global Oil Production

This chart looks at the world based on oil production data from the EIA. The dark blue countries are heavy producers with light blue representing small to medium size producers.

There should be no obvious surprises on this map. We could tweak it for different types of commodities, but I think it does a good enough job for our purposes, which is really to get to the next chart.

Geopolitics Meets Energy

This next chart attempts to meld the two charts into one. The concept is to identify regions for Academy Securities to focus on in terms of how the Geopolitical Risk can affect markets, but particularly, energy markets.

The dark blue is ‘safe’ energy production.

From a U.S. perspective, not only does energy production/energy independence create good jobs that support the economy, it plays into national defense as we aren’t reliant on foreign sources. Not being subject to the whims of other nations, particularly those with high levels of geopolitical risk is extremely beneficial. Our Geopolitical Intelligence group has also been able to help guide companies and investors through some of possible legislation that could impact the industry.

What is sometimes overlooked, is how important it is for other countries to secure sources of oil and liquid natural gas from stable suppliers. The combination of being ‘safe’ and a big producer is extremely powerful. It will play a role in our trade negotiations with China.

The map also highlights why we should continue to see higher volatility in Brent prices relative to WTI, with that spread often influenced by geopolitical issues.

To be brutally honest, the light red and red areas aren’t that important for our discussions on energy. They are areas of high geopolitical risk and are important in some cases to the global economy and particularly important to investors, especially if they are bond issuers, but they don’t play a major role in determining the price of oil.

Then we get to the heart of the matter – the purple zones. Purple represents the dangerous combination of high Geopolitical Risk with high energy production. These are the ‘hotspots’ that we will focus our geopolitical knowledge and resources on, in our efforts to help the macro analysis on energy prices. Much of the map is obvious, but I think the visual effect of the map is powerful in really drawing your attention to the hotspots.

Mexico jumps out at me.

The Middle East seems to be constantly in the news and while the latest developments in the Kingdom of Saudi Arabia have upped the ante, we’ve already discussed that in the SITREPS mentioned earlier (and we will continue to adapt our view as necessary as information comes out – though hopefully we will turn out to be right – we have been tracking the potential impact on Aerospace and Defense stocks and bonds – which you should have received earlier in the week).

Russia is another obvious area and one that we focus on regularly in our SITREPS and Podcasts.

But on this first cut, it is Mexico that stands out. We have just announced a trade agreement with Canada and Mexico and the currency is much stronger than it was in June, ahead of Mexico’s election, yet it shows up as still being relatively high on the Geopolitical Risk front and is a major energy producer.

Next Steps

The most obvious next step is doing a report on Mexico. We also are in the process of consolidating our geopolitical views on the purple regions to help formulate our views on energy prices.

We certainly think that the ‘safe’ production of the U.S. will play an important role in our trade negotiations with China (liquid natural gas is an obvious choice to reduce the trade deficit as China needs it and we produce it – cheaply and with low risk of unexpected supply disruptions).

On the sales and trading side of things, John Chang, another recently hired Marine Corps veteran, who is one of our agency discount note and corporate bond traders, is starting to send out runs on investment grade (and some high yield) energy bonds so that we can more directly translate our geopolitical and macro views into tradeable ideas.

Thank you for all your efforts and support and we look forward to continuing to grow and develop the products and services that can help you in your business or portfolio.

Original Post 10/22/2018

Update: Complexities of the Kingdom

Key Points:

• The Kingdom of Saudi Arabia (KSA) is being blamed for the disappearance and possible death of U.S. resident and journalist, Jamal Khashoggi

• The Trump administration is considering sanctions against the Kingdom in response

• Mohammed bin Salman (MBS) may have damaged his position as future King

• Long term impact of military contracts with KSA are unlikely to be negative

Background:

• On October 2, Jamal Khashoggi, a Saudi citizen and U.S. resident, was last seen entering the Saudi Consulate in Istanbul

• Khashoggi, previously enjoyed a close relationship with the Saudi Royal Family, serving as an adviser to the director of Saudi Arabia’s Intelligence Agency

• President Trump threatened harsh punishment if it was proven Saudi Arabia was responsible for Khashoggi’s death

• U.S. allies, Britain, France, and Germany called for a credible investigation by Saudi and Turkish authorities

What Has Happened:

It has been reported that the Saudis will take some responsibility for Khashoggi’s death – claiming it was the result of an interrogation gone awry. Given the escalating tensions and international attention and condemnation, Secretary of State, Mike Pompeo, has travels to Saudi Arabia to meet with MBS. The concern over the death of Khashoggi is only complicated by the strained relationship with traditional U.S. ally, Turkey. The Trump administration is facing internal pressure from a Congress already skeptical of Saudi Arabia’s handling of the war in Yemen and the cursory U.S. support for the conflict.

Why it Matters:

“I’m worried about succession challenges now and was not before. This event will be blamed on MBS internationally and it marks him both externally and internally. While his father, the King, can broker this while alive, I suspect others who may aspire to the crown may believe MBS is a marked man internationally. We need to watch how the royals react and keep an ear to the ground about how well this act is accepted internally. Ambitious competitors for the crown could see an opportunity.”

Lieutenant General Frank Kearney, Academy Securities’ Advisory Board Member

“The business environment with respect to KSA will be affected by this situation in the near-term (eg. reduced participation in KSA investment conference next week), but will remain essentially unaffected in the long-term. The geo-strategic importance of the U.S./KSA relationship, relative to larger Mid-East concerns, is too important to let this incident impact long-term business partnerships and/or foreign military sales agreements. That said, the media coverage surrounding this incident will demand some semblance of a response. It will be crafted to be meaningful in the near-term, but not harmful in the long run. “

Lieutenant General David Deptula, Academy Securities’ Advisory Board Member

Original Post 10/15/2018

Complexities of the Kingdom

Key Points:

• The Kingdom of Saudi Arabia (KSA) is being blamed for the disappearance and possible death of U.S. resident and journalist, Jamal Khashoggi

• The Trump administration is considering sanctions against the kingdom in response

• Saudi Arabia has vowed retaliation if sanctions are imposed

• The U.S. relationship with Saudi Arabia has long been complicated and continues to be. If sanctions are imposed, some economic and military ties will remain unchanged even if diplomatic stridency and public outrage increase

Background:

• On October 2, Jamal Khashoggi, a Saudi citizen and U.S. resident, was last seen entering the Saudi consulate in Istanbul

• Khashoggi, previously enjoyed a close relationship with the Saudi Royal Family, serving as an adviser to the director of Saudi Arabia’s Intelligence Agency

• Khashoggi became critical of the oppressive regime in the kingdom, becoming a vocal opponent of the Religious Police and the ultra-conservative interpretation of Islam imposed by the government

• Most recently, Khashoggi published critiques of Mohammed bin Salman (MBS) – a supposed advocate for reform and liberalism

• Khashoggi has been critical over Saudi Arabia’s diplomatic break with Qatar and the war in Yemen, as well as Saudi Arabia’s policy toward Iran

• In June 2017, Khashoggi, fearing arrest, left Saudi Arabia, resettling in the U.S.

“I have left my home, my family and my job, and I am raising my voice, to do otherwise would betray those who languish in prison. I can speak when so many cannot. I want you to know that Saudi Arabia has not always been as it is now. We Saudis deserve better.” Jamal Khashoggi

What Has Happened:

International attention and pressure have mounted on Saudi Arabia. President Trump has promised a serious punishment if it is determined Saudi Arabia killed Jamal Khashoggi. This weekend KSA responded that they would retaliate if the U.S. imposed sanctions. Saudi Arabia has argued that any sanctions on the kingdom would drive up oil prices, ultimately hurting the U.S. and its allies. U.S. allies, Britain, France, and Germany called for a credible investigation by Saudi and Turkish authorities.

Why it Matters:

“I suspect that MBS has made a grave error if the murder accusations are true. I believe if nothing comes out from the Kingdom, other than defensive threats to those questioning why there is no response, then relations will continue to decline. This can have a significant impact on US defense industries (given the extensive Saudi contracts) and could likely cause a reactive rise in oil prices just because of the international attention – even without Saudi retaliation to any US actions. Fear will drive the oil market without clarity of intentions. I don’t think the President wants to take economic actions and it is likely sanctions would have to be creative if imposed to allow defense contracts to continue. Saudi threats to lean toward Russian or Chinese military equipment are real and when we have not sold them defense articles in the past, they have gone elsewhere. Congressional and press pressures ahead of elections will drive the administration to take some action as the U.S. public is unlikely to consider the complexities of actions and counter reactions, they rightfully expect our government not to tolerate an attack on a U.S. resident and member of the press.”

Lieutenant General Frank Kearney, Academy Securities’ Advisory Board Member.

Given General Kearney’s assessment, I think we can see a few short-term impacts. The implications of these actions, even if overblown, will resonate with a market already nervous heading into midterm elections.

More weakness in treasuries as KSA will need to fund their current expenses and selling treasuries (which they owned $166 billion as of the last TIC report – up from $90 billion in October 2016. Often, we would expect risky situations to cause a flight to quality and benefit treasuries, but when KSA has had to sell assets before to support their generous public payouts – treasuries (and stocks have suffered). We might expect to see a divergence between Brent crude and WTI. KSA is already selling to China in Chinese currency and this could accelerate that move. My view on the long-term potential of LNG may still hold, but near term, it could be under pressure if KSA further embraces China. I would avoid dollar denominated debt of KSA and its major banks at this point. As we saw in Turkey – the potential for the ‘situation’ and markets to get out of control is high.

Peter Tchir, Academy Securities’ Head of Macro Strategy

Original Post 10/14/2018

Iran: Rockets, Sanctions, Treaties

Key Points:

- Tensions with Iran have increased but military posture has not strengthened

- International support is needed for the Trump administration’s sanctions to be effective

- Iran is a malignant global actor but engagement with Iran is necessary for a diplomatic resolution

- There is a real risk of unintentional conflict escalation with Iran

Background:

Over the past two weeks, tensions with Iran have loomed large. In the final month before the U.S. reimposes harsh sanctions on the Islamic Republic, both Iran and the U.S. are on a campaign to garner support from the international community. Iran remains a destabilizing actor on the global stage. However, our Geopolitical Intelligence Group has argued that continued engagement (and sometimes cooperation) with Iran is a necessary element to achieving our national interests and tempering the destructive and dangerous influences of Iran.

What Has Happened:

Recently, we have seen the Trump Administration compelled to act diplomatically, rhetorically, and militarily. While addressing the UN, President Trump described Iran as a “corrupt dictatorship” that “sows chaos, death, and destruction.” The State Department, citing risks from Iran, closed its consulate in Basra, Iraq. Though no damages or injuries were reported, rockets fired from Iran landed some 300 yards from the consulate hours before its announced closing. The State Department also walked away from a mostly immaterial, 60-year-old treaty between the U.S. and Iran in response to a ruling from the International Court of Justice – that U.S. sanctions on Iran must exempt humanitarian items. In contrast with the public rhetoric rows, U.S. military presence has been noticeably absent in the Persian Gulf. There has not been an aircraft carrier presence in the region since earlier this Spring – when a shift to counter Russia and China began to take shape.

Why it Matters:

Iran, while not under the same strategic threat umbrella as China and Russia, is a significant pillar of the Trump administration’s National Security Strategy. Iran’s militarized nuclear ambition and its provocative military and cyber-attacks are threats to the United States. Iran is an enemy. Since the rise of ISIS, the Western Coalition and the Kurdish Militias, along with Iran, were critical to the diminishing footprint and capabilities of ISIS in Syria and Iraq. However, Iran’s primary motivation in Syria is to ensure Assad remains in power. Syria continues to be a chaotic and dangerous mess. If the U.S. hopes to see stability in the region and stymie the flow of refugees, it will need to communicate and cooperate with Iran. As we near the Nov 4th initiation of renewed sanctions (since the President refused to recertify the JCPOA), the U.S. will rely on its allies to help enforce its vision of containing a nuclear Iran. The objective of the sanctions is clear, but how they will be applied and enforced without international cooperation remains uncertain.

“The United States’ unilateral withdrawal from the JCPOA has fueled the fight of hate, which is the core ideological tenet of the revolution. Another generation of Iranian youth now has had the narrative reinforced that the West is untrustworthy and remains the “evil Satan.” The attacks in Syria fit into the Iranian revolutionary narrative as well. The IRGC, as keepers of the revolution, are like excited particles seeking engagement. The stage is set for miscalculation and the unintended escalation of any single event is possible. The circumstances we find ourselves in are partially of our own making and we have played into the Iranian narrative which has strengthened its hardliners and shaped the outlook of the country’s youth. We need to recognize that we are the only nation which can physically destroy the Iranian nuclear program if required. The JCPOA did nothing to reduce our capability yet we act as though we have lost some capability. Our sanctions will take a long time to have any effect and likely will have grudging European support. The Russians and Chinese have no reason to support U.S. sanctions and will be spoilers. The Trump administration’s path is not clear, but their rhetoric and actions will lead to countermeasures by the Iranians and its surrogates. We need to be on watch, as I am sure our military commanders are, to ensure we are not accidentally pulled into a dangerous situation we do not seek.”

Lieutenant General Frank Kearney Academy Securities’ Advisory Board Member.

Original Post 10/5/2018